Do job listing trends indicate future layoffs?

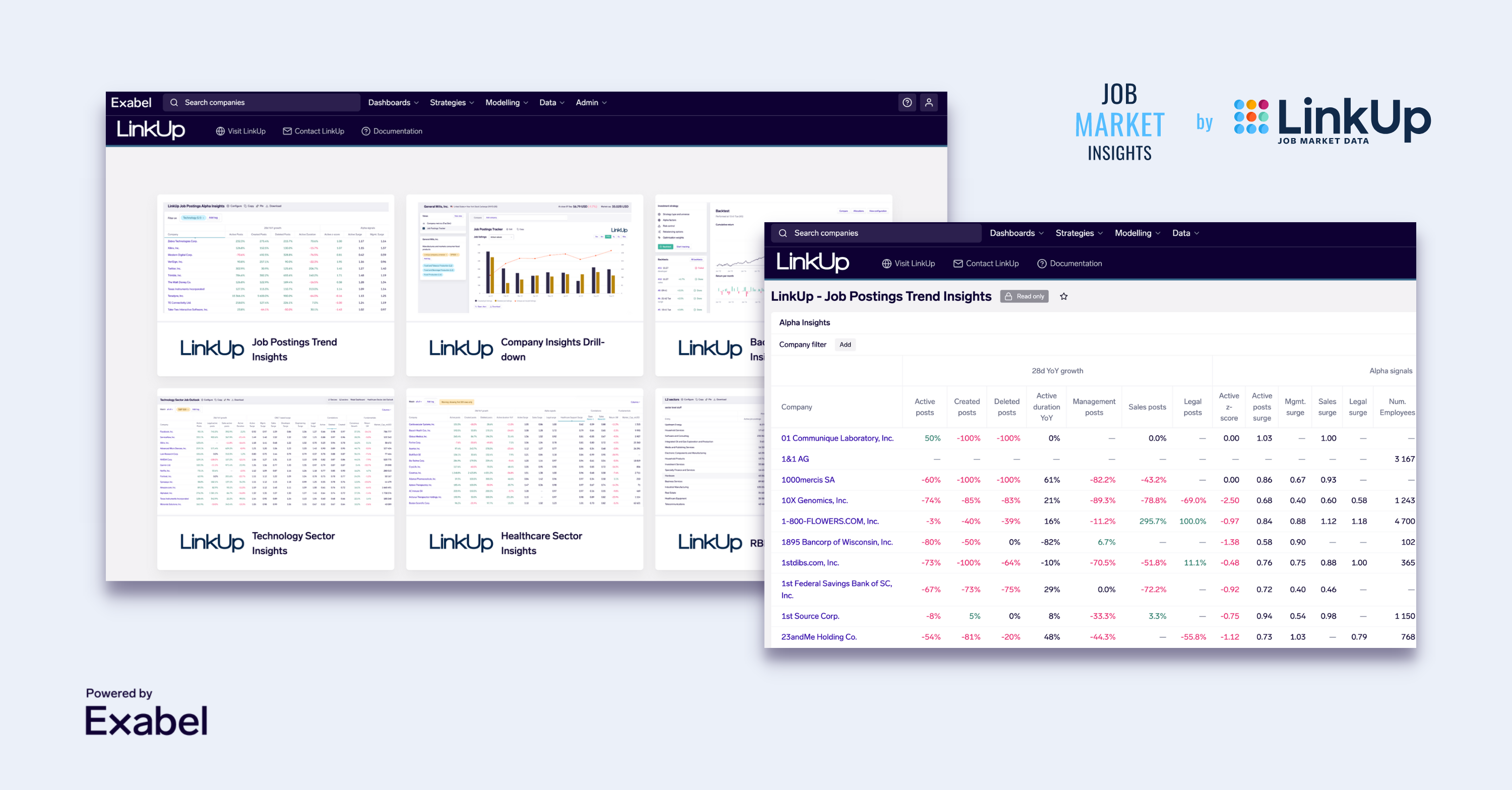

Job Market Insights by LinkUp, powered by Exabel, is a powerful platform to analyze the job listings activity for over 9000 companies across sectors and geographies. This dataset has proven to be valuable to investors, as hiring trends have been indicative of upcoming layoffs, and provide insight into management’s business outlook. In this example, we look at job listing trends in the software and payments companies, leveraging data from LinkUp.

You can access a free, no commitment trial of these and more insights by signing up here.

Software companies

There have been multiple indications of impending layoffs from Salesforce (CRM US) executives in the recent past. Over the last 3 quarters, its revenue growth has been trending downwards with YoY growth being reduced by half over a span of 2 quarters.

A user can navigate to the job listing trends dashboard on LinkUp landing page. A personal watchlist or portfolio can be uploaded and saved as a tag on the platform. This can then be selected to filter out the companies of choice, which then becomes the default view for the user. Similarly, a user can filter based on RBICS industry classification which are pre-loaded as tags on the platform. We proceed with filtering for the “Software and Consulting” RBICS sector.

The dashboard can be sorted on any column to help a user identify top companies based on any metric of interest. The dashboard serves a very important purpose of allowing a user to filter for companies of interest and identify inflections and trends in various job activity metrics. By filtering for >$100b market cap and sorting on active job listings YoY, we quickly identify Salesforce as showing a steep decline, with listings down by 90% across all roles – management, sales and legal.

More details are available to a user on the dedicated insights page of Salesforce, which can be navigated to from the dashboard. This page allows users to dive deeper into company specific trends and insights. Figure 2 below shows the monthly job listing activity over the last year. We observe three specific months where job deletions exceeded the job listings – June, July and November 2022.

This trend was observed months before Salesforce announced a slowdown in its revenue growth in August last year. A user would have identified signs of an impending layoff from LinkUp job data months before it surfaced publicly in November and January. This is demonstrated in the figure below. It shows a sharp drop in active job listing with concurrent rise of job listing duration months before slowdown was announced by Salesforce (red line). Though the drop was observed across all occupations, the top 3 occupations – management, sales, and computer related roles – experienced sharp declines in absolute terms. The trend continued months after the announcement leading up to multiple episodes of layoffs (green and yellow) as shown below.

Payments solution providers

We next look at some of the prominent payments solution providers within the “Specialty Finance” sector. Using the entity picker we can filter for Mastercard (MA US), Visa (V US), American Express (AXP US), and Paypal (PYPL US). Mastercard has been showing a very different trend compared to its peers with accelerated hiring over the last one year. An 82% annual growth in active job posts strongly corroborates the above. More insights from Mastercard’s job listing activity can be found here.

On the other end of the scale, Mastercard’s primary competitor, Visa, has been going slow on their hiring. With a 73% YoY drop in active job listings, Visa ranks the top within its peer group in reducing headcount. American Express also has been consistently dialing down on their hiring indicated here by a 69% drop. Paypal recently announced its second layoffs on Jan 31st where it eliminated close to 7% of its workforce. We have been observing its active job listings drop significantly below its historical levels since mid-2022, leading up to the news. Deeper insights on Visa, Paypal and American Express using LinkUp job activity data are available on the platform.

The figure below highlights the trend in the job listing activity since the start of last year. A clear divergence among the two is seen since August 2022, with Mastercard almost doubling its momentum and its peers tightening on its hiring plans.

We construct a moving average ratio (MA ratio) metric to capture the relative growth in short and long term in the active job listings for Mastercard. The signal construction is explained below –

MA ratio (signal)s,l = (MAs/ MAl)

where MAn= moving average of the signal with a window of n days,

s = shorter lookback horizon, and

l = longer lookback horizon

In our example, short-term and long-term lookback periods are 14 and 91 days respectively. The signal used is the active daily job listings for Mastercard. On overlaying the daily close price on surge, we observe an interesting trend of co-movement of the two signals. Between June and November 2021 the ratio dropped by 18% and the price slumped by 22%. We observe another period between September and November 2022 where the ratio surged 26%. This was followed by a price increase to the tune of 35% as seen below.

Power your investment decision-making with LinkUp’s Job Market Insights:

- In-depth view of the labor market at the sector and company level

- Analyze hiring activity to get ahead of movements in company share price

- Access up to 1,800+ companies split into 22 packages based on industry and geography

Get started for free today – no card, no commitment.