DecaData launches their Insights Platform, powered by Exabel.

The Odyssey dataset from Decadata is a comprehensive collection of consumer transactions at Point of Sale checkouts. With full history since 2007, the dataset encompasses every transaction and every item being scanned and purchased at checkouts across more than 1000 stores owned by 5 of their retailer partners. This dataset is a valuable resource for the Consumer Packaged Goods (CPG) industry as it provides a unique, real-time window into the sales and performance of brands and companies. The dataset includes proprietary point-in-time mapping of the items’ brand names into the public tickers of manufacturers in the CPG industry, providing users with a comprehensive and actionable view of the market.

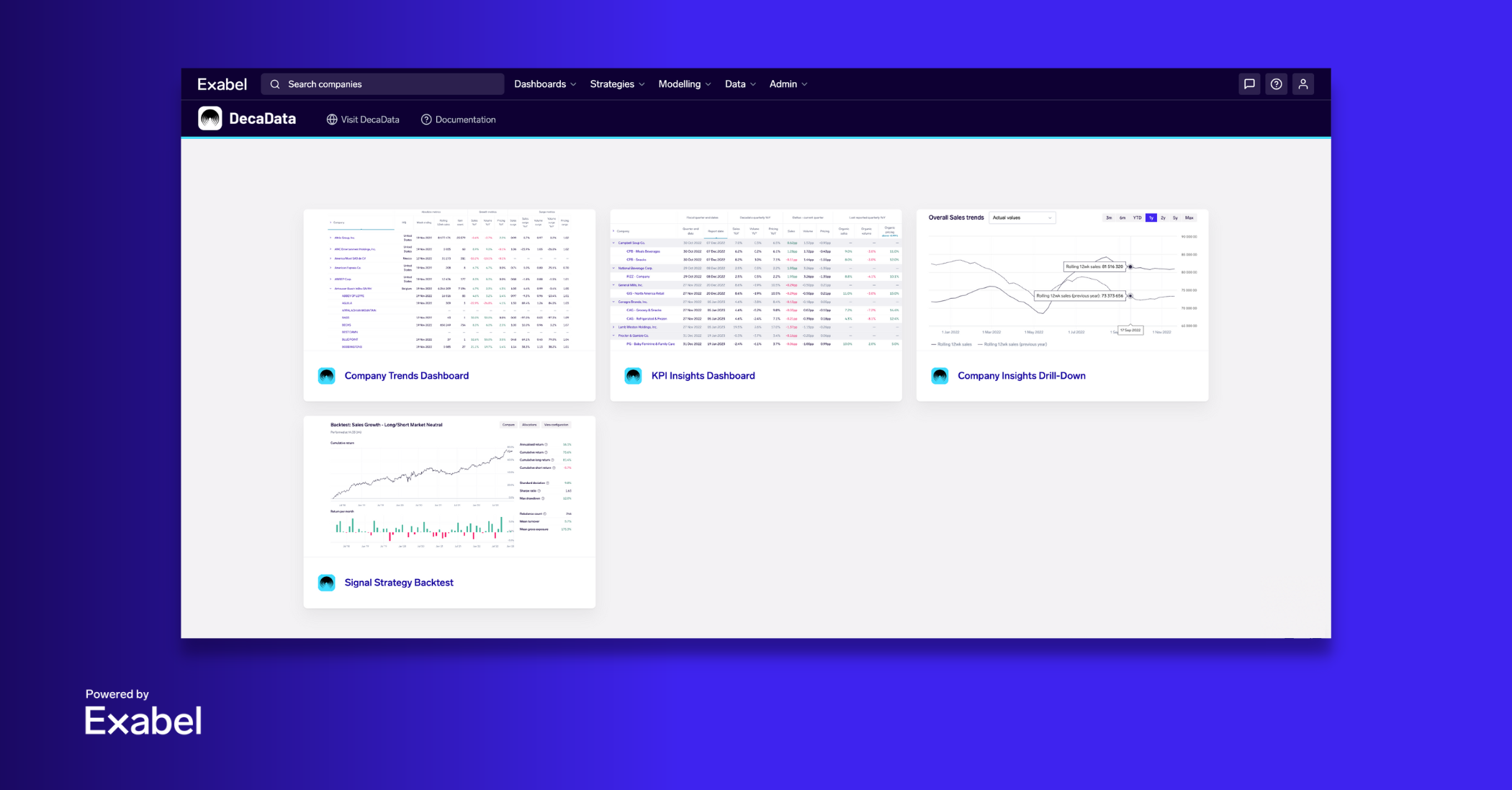

Using the DecaData Insights Platform, powered by Exabel, investment professionals can derive unique insights from US consumer transaction data within their investment research.

DecaData’s data panel has demonstrated an excellent correlation of 0.92 with Campbell Soup (CPB) Meals and Beverages segment with respect to capturing trends in organic sales growth. The data shows deceleration in the pace of Volume YoY as well as Pricing YoY for the segment for 2023 FQ2 as compared to FQ1. Together, these resulted in deceleration in Organic Sales growth for this segment compared to 2022 FQ1. Volume and Pricing YoY has continued to decelerate into FQ3 since the start of February , resulting in Organic Sales YoY going down by 480 bps by the end of FQ2 (and still going down into the current quarter)

A look at the top brands of CPB indicates 4 out of their top 5 brands experiencing significant decelerations with respect to year-over-year volume sales, specifically with their biggest brand Campbell’s demonstrating significant decline in volume.

To ensure that these numbers are not driven by outliers, we analyze these trends for the month of February and March in 2023 at an item level. The histogram for YoY volume distributions is distributed heavily around -12% to -7% decline with the median coming to around -8.3% in the given period.

Most interesting, we see a correlation where item-level price rises are correlating to volume decline. This is shown in the last scatter plot.

Decadata’s shopper panel tends to be more price sensitive than coastal shoppers but analysis indicates that price rises are having a large effect on volume consumption,contradicting the CPB’s investor storyline, where they argue in their slides that price-conscious shoppers are spurning eat-outs in favor of dining in with CPB packaged products.

Odyssey 2 data best lends itself to measuring and modeling CPB’s consumer domestic segment. Looking only at FQ2 2023 and comparing it with the previous quarter, we see there is immense value in the data pointing to deceleration in volume and sales. The ODY data saw a -3.2% YoY decline in volume while the reported numbers reflected a -4% decline in organic volume YoY. Note that the level of decline in volume from the data might point to a slightly different level of decline in reported numbers, but the direction is a very key aspect that we get a sense of very early into the quarter before the earnings are announced.

About the platform

DecaData is a consumer data analytics company that was founded in 2018. Our company specialises in aggregating and analysing consumer transaction data from our partnerships with US grocery retailers and supermarket chains. Our unique approach allows us to provide multi-faceted datasets that encompass granular insights into not only consumer purchases at checkout but also retailers’ inventory levels and shipment orders across distribution channels. These datasets enable us to provide a holistic, 360-degree view of demand from consumers, retailers, and distributors, leading to monetizable data insights.

To find out more or see the product in action, get in touch.

General disclaimer

This document is provided by Exabel AS. It is for information purposes only. It is not an invitation or inducement to engage in any investment activity and it does not contain investment advice. The information in this document shall not be relied on in making any investment decision or in connection with any contract or otherwise. Exabel AS makes no representation regarding, and accepts no liability or duty of care for, the accuracy, completeness or timeliness of the information in this document or its fitness for any particular purpose or use.