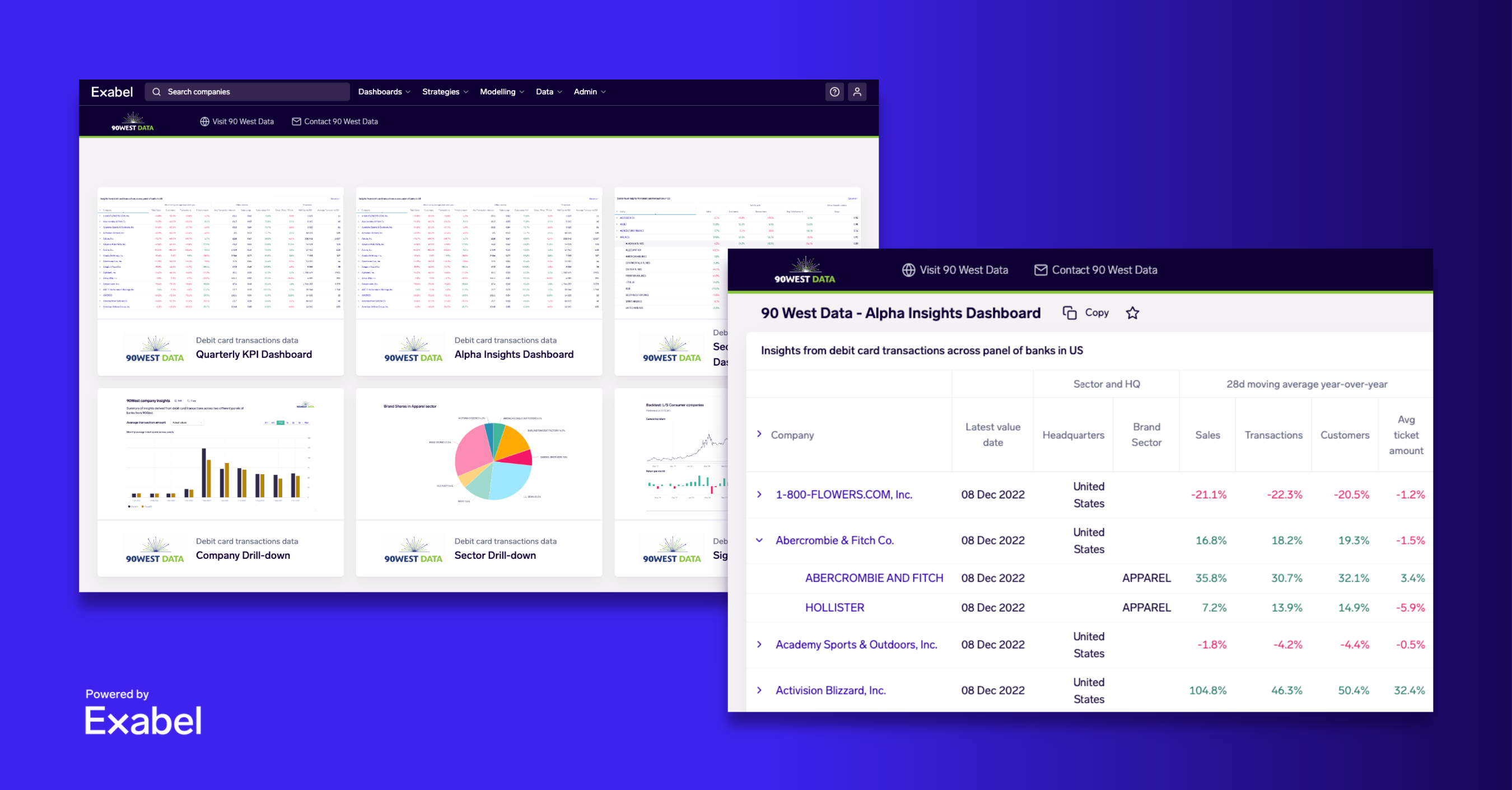

90 West Data and Exabel team up to offer new service providing hedge fund level insight into US debit card transaction data at affordable prices

- New service provides analyses of U.S. debit card spending, helping investors identify trends and brand performance ahead of other available data

- It covers over 200 brands and 77 publicly traded U.S. companies

- Prices start from just $40 a month per ticker

Leading data vendor 90 West has teamed up with Exabel to launch a new service that provides affordable access to insights from U.S. debit card transactional data for investment analysts and portfolio managers.

Consumer Spending Insights by 90 West, powered by Exabel, provides analysis of debit card transaction data tracking the spending patterns of over 750,000 US consumers. With data mapped to 235 brands, 77 publicly traded U.S. companies and 217 sectors, customers can enhance their research with insight previously only available to top tier hedge funds, at a uniquely accessible price point of $40 a month per ticker.

The new service empowers investors to identify trends and brand performance in advance of other available data from companies or government bodies. They can develop a better understanding of key issues including:

- What are the latest trends in US consumer spending?

- Which brands are winning by current mid-quarter sales?

- Who has the largest market share growth in a sector?

- Which sector has the highest transaction volume and consumer concentration?

- Which businesses are rapidly changing based on inflections?

John Farrall, CEO & Co-Founder at 90 West said: “Together with Exabel, we developed our Consumer Spending Insights offering, the first affordable service that puts decision makers in position to develop an early read on consumer spending trends, and how these trends might affect a range of companies.

“For example, the Consumer Spending Insights offering can provide investors an early read on individual merchant performance, and market share changes within a given sector.”

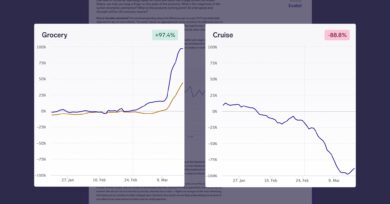

Neil Chapman, Chief Executive Officer, Exabel, said: “The Data driving Consumer Spending Insights is typically delivered to us within two to three days after transactions are made*, enabling investors to derive unique investment insights that enhance their fundamental research process way ahead of the traditional information flow via company filings or other sector level reports.

“Our users can track sector level trends that lead traditional market indicators by weeks or months and drill down to company and brand level insights to identify consumer spending impact on company performance ahead of the market.

“The most sophisticated hedge funds might need to invest between $200,000 and $1 million a year for access to a debit and credit card transaction dataset which in turn requires a data science team to extract and analyse results. Together with 90 West, we have been able to develop a new unique service that provides these valuable insights at affordable prices, direct to the investment professionals via easy to use dashboards and visualisations without the need for quants or data scientists to work with the raw data.”

Companies covered by the data include household name brands such as Amazon, Denny’s Group, Gap, Lyft, American Airlines, Nike, Macys, Peloton, Spotify, Starbucks, Target, Walt Disney and Uber.